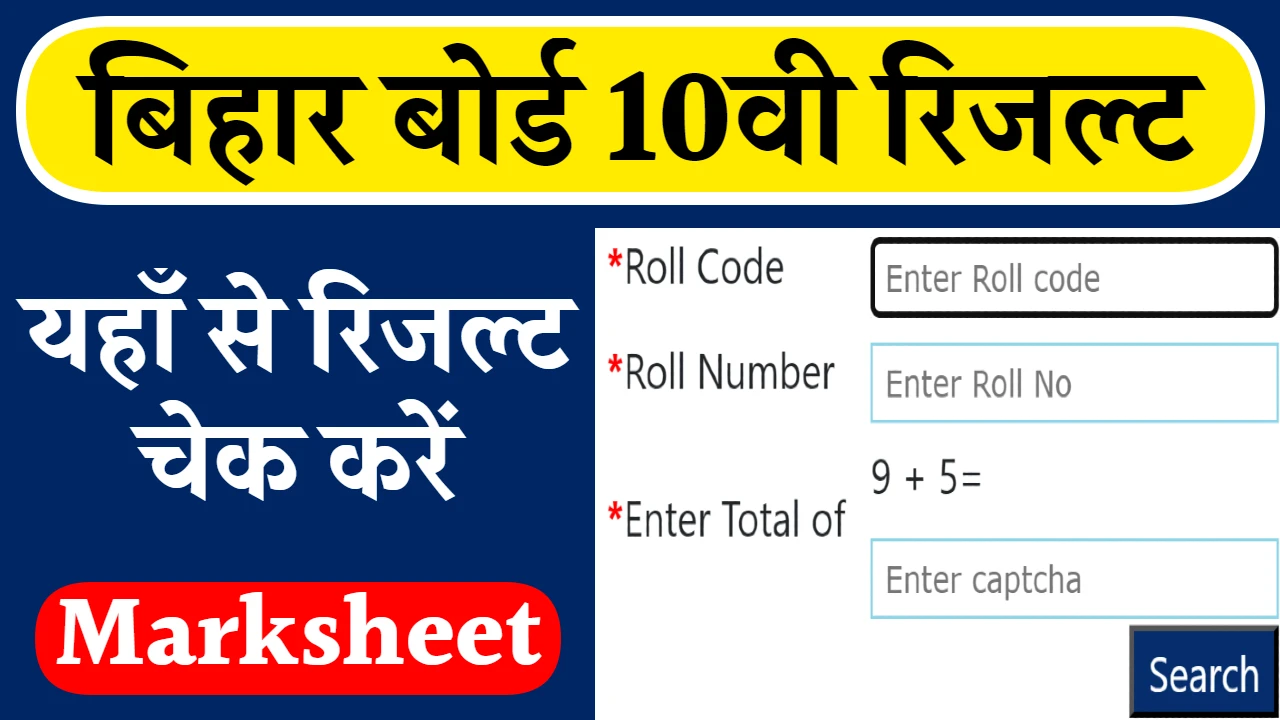

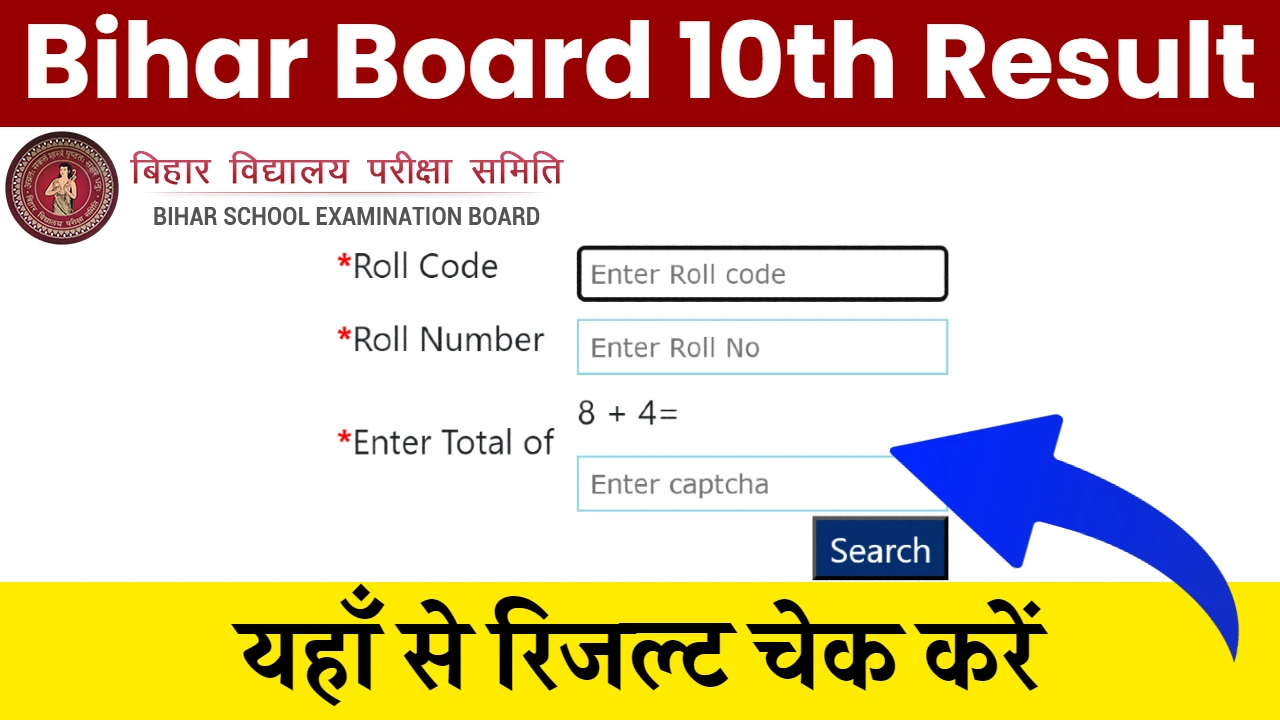

Bihar Board 10th Result Jaari: बिहार बोर्ड ने जारी कर दिया 10वी का रिजल्ट, यहाँ से चेक करें

बीएसईबी के द्वारा बिहार राज्य में हर वर्ष कक्षा दसवीं के विद्यार्थियों के लिए बोर्ड की परीक्षा जारी करवाई जाती है जिसके अंतर्गत कक्षा दसवीं के परीक्षार्थियों को विशेष परीक्षा के दौरान अगली कक्षा में प्रवेश देने के लिए चयनित किया जाता है। हर वर्ष की तरह 2024 में भी बिहार राज्य के कक्षा दसवीं … Read more